How to Recover from a Liquidity Pool Scam

Recover from a Liquidity Pool Scam: In the ever-evolving landscape of cryptocurrencies and decentralized finance (DeFi), liquidity pool scams have unfortunately become a real concern for investors. Falling victim to a liquidity pool scam can be disheartening and financially devastating. However, it’s important to remember that recovery is possible. In this blog post, we’ll discuss steps you can take to recover from a liquidity pool scam and safeguard your future investments.

- Acknowledge and Accept: The first step towards recovery is acknowledging that you’ve been a victim of a liquidity pool scam. Accept that mistakes happen, even to the most cautious investors. It’s crucial not to dwell on the past, but instead focus on the actions you can take moving forward.

- Gather Information: Collect all the information you have about the scam. This includes transaction details, addresses, emails, and any communication you had with the scammers. Having a comprehensive record can be useful if you decide to involve law enforcement or seek legal assistance.

- Contact Authorities: Report the scam to relevant authorities, such as local law enforcement, the cybercrime unit, or financial regulatory bodies. While recovering stolen funds might be challenging, reporting the scam can help prevent further victims and aid in the investigation of fraudulent activities.

- Seek Legal Counsel: Consider consulting with a legal professional experienced in cryptocurrency and financial fraud. They can guide you through your options and help determine if pursuing legal action against the scammers is feasible.

- Educate Yourself: Take the time to educate yourself about the nature of liquidity pool scams, how they operate, and the red flags to watch out for. This knowledge will empower you to make informed investment decisions in the future.

- Secure Your Accounts: Change passwords and enable two-factor authentication (2FA) on all your accounts, including your crypto exchange accounts, wallet, and email. This adds an extra layer of security to prevent unauthorized access.

- Learn from Mistakes: Reflect on what led to your involvement in the liquidity pool scam. Did you fall for a convincing phishing email? Were you enticed by promises of unrealistic returns? Understanding your vulnerabilities will help you make wiser investment choices in the future.

- Diversify and Research: Before making any new investments, conduct thorough research. Look for well-established projects with transparent teams and a track record of delivering on promises. Diversify your investments to reduce risk.

- Community Support: Connect with online communities and forums dedicated to cryptocurrency and DeFi. Discussing your experience with others can provide emotional support and valuable insights to prevent future scams.

- Stay Informed: Stay updated on the latest trends, news, and security practices in the cryptocurrency and DeFi space. Being well-informed is your best defense against falling prey to scams in the future.

Recover from a Liquidity Pool Scam: Recognizing That You Have Fallen Victim to a Liquidity Pool Scam

Recover from a Liquidity Pool Scam: The decentralized finance (DeFi) space has revolutionized the way we interact with cryptocurrencies and financial platforms. However, the rise of innovative technologies has also given rise to scams and fraudulent activities, including liquidity pool scams. Falling victim to such scams can be distressing, but recognizing the signs early is crucial to minimizing the damage.

Signs of a Liquidity Pool Scam:

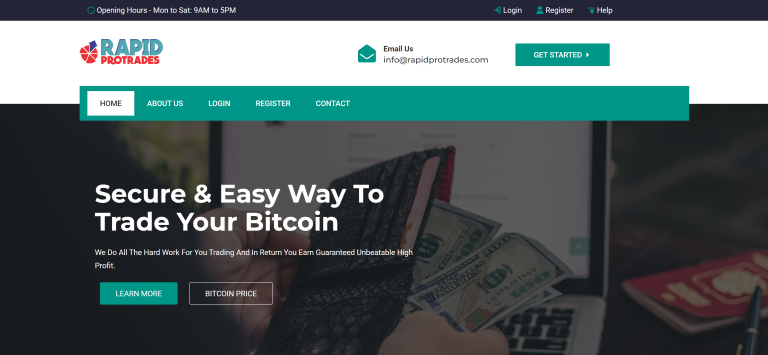

- Unrealistic Returns: Scammers often promise incredibly high returns on investment that are too good to be true. If an investment opportunity guarantees sky-high profits with minimal risk, exercise caution.

- Lack of Transparency: Legitimate DeFi projects typically provide detailed information about their team, project goals, and operations. If you find a lack of transparency about the project’s fundamentals, it’s a red flag.

- Pressure to Act Quickly: Scammers create a sense of urgency to pressure victims into making hasty investment decisions. If you’re being pushed to invest immediately, take a step back and thoroughly evaluate the opportunity.

- Unsolicited Offers: Be wary of unsolicited emails, messages, or social media posts promoting an investment opportunity. Scammers often reach out to potential victims out of the blue.

- Unverifiable Information: Scammers might provide false or unverifiable information about their project’s partnerships, affiliations, or endorsements. Verify any claims independently.

- Complexity and Jargon: Scammers often use complex jargon and technical language to confuse victims and make their scam appear more legitimate. If you don’t understand an investment opportunity, seek advice before proceeding.

Seeking Legal Assistance and Consulting with Experts in Cryptocurrency Recovery

Recover from a Liquidity Pool Scam: It is recommended to seek legal assistance and consult with experts in cryptocurrency recovery. This can be done through cryptocurrency recovery services that specialize in assisting individuals who have fallen victim to scams and lost their funds.

By engaging the services of these professionals, you can benefit from their expertise and experience in navigating the complexities of cryptocurrency fraud cases. They will assist you in recovering your lost funds, providing guidance throughout the process. Additionally, consulting with legal professionals who specialize in scam victims’ rights is crucial. These experts understand the legal landscape surrounding cryptocurrency scams and can provide you with valuable advice on how to proceed legally.

When seeking legal assistance or consulting with experts, it is important to choose reputable professionals who have a proven track record in dealing with similar cases. Conduct thorough research and consider referrals or recommendations from trusted sources before making a decision.

Remember that every situation is unique, so it’s essential to share all relevant information about your case during these consultations. This will enable the professionals to assess your situation accurately and provide tailored advice for your specific circumstances.

Conclusion:

Recovering from a liquidity pool scam is a challenging process, but it’s important to remember that you’re not alone. By taking proactive steps, seeking support, and learning from your experience, you can rebuild your financial confidence and make smarter investment decisions moving forward. Remember, your resilience and determination will play a pivotal role in your journey to recovery.