Navigating the Shadows: Unveiling Ethereum and USDT Scams

Ethereum and USDT Scams: In the ever-expanding universe of cryptocurrencies, Ethereum and Tether (USDT) stand out as two prominent and widely used digital assets. Both have gained immense popularity for their unique functionalities and benefits. However, with popularity comes a darker side, one that is inhabited by scammers and fraudsters. In this article, we’ll delve into the world of Ethereum and USDT scams, examining the common scams associated with these cryptocurrencies and how to safeguard your assets.

You can open a case with Cyberspac3.

Ethereum: The Beacon of Decentralization

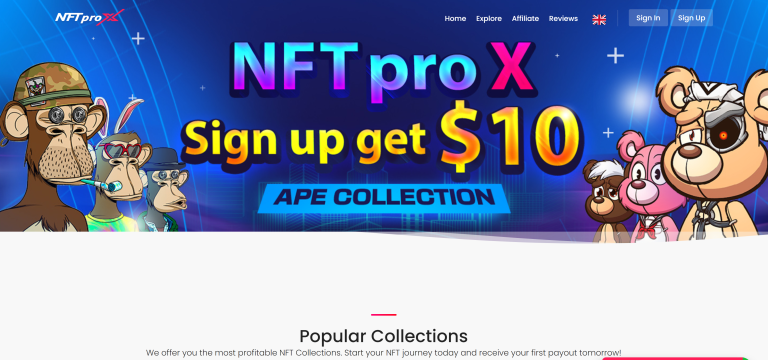

Ethereum and USDT Scams: Ethereum is often regarded as the pioneer of smart contracts and decentralized applications (Dapps). Its blockchain enables developers to create a wide array of applications, from DeFi platforms to non-fungible tokens (NFTs). While Ethereum’s versatility is a testament to its potential, it also opens doors to a range of scams:

- Phishing Scams: Ethereum wallets and Dapps are prime targets for phishing scams. Scammers often create fake websites or applications that closely mimic legitimate services, tricking users into revealing their private keys or credentials.

- Ponzi Schemes: Ethereum has seen its share of Ponzi schemes and investment scams. These fraudulent platforms promise high returns on investments but ultimately collapse, leaving investors with losses.

- Smart Contract Vulnerabilities: Smart contracts on the Ethereum blockchain are not immune to vulnerabilities. Coding errors or flawed contract designs can result in exploitation by malicious actors, leading to asset losses.

- Initial Coin Offering (ICO) Scams: During the ICO boom, Ethereum was frequently used for token sales. Some of these ICOs turned out to be scams, and investors lost substantial amounts.

You can open a case with Cyberspac3.

USDT: The Stablecoin Temptation

Ethereum and USDT Scams: Tether (USDT), a stablecoin, has gained prominence for its peg to the US dollar. This price stability makes it a preferred choice for traders and investors. However, the stablecoin arena also attracts scammers:

- Fake Airdrops: Scammers often promote fake USDT airdrops, luring users with promises of free tokens. In reality, these schemes aim to collect personal information or steal funds.

- Counterfeit USDT: Counterfeit USDT tokens circulate in the market. Users should ensure they acquire USDT from reputable exchanges and verify their authenticity.

- Impersonation Scams: Scammers impersonate customer support or official entities related to USDT. They solicit sensitive information or request funds for purported issues.

- Pump-and-Dump Schemes: Some scammers manipulate the price of USDT or use it as a base currency for pump-and-dump schemes, causing price fluctuations and leading to losses for unsuspecting traders.

You can open a case with Cyberspac3.

Safeguarding Your Assets

Ethereum and USDT Scams: Protecting your assets from Ethereum and USDT scams requires vigilance and caution. Here are essential steps to safeguard your investments:

- Verify URLs: Always verify the authenticity of websites and applications by double-checking URLs. Be cautious of phishing websites with slight variations in the domain name.

- Use Secure Wallets: Utilize reputable and secure wallets for storing Ethereum and USDT. Hardware wallets are often considered the safest option.

- Stay Informed: Stay informed about the latest scams and fraud schemes in the cryptocurrency space. Awareness is your best defense.

- Be Skeptical: Exercise skepticism when presented with offers that seem too good to be true. High returns with little effort are often a red flag.

- Beware of Impersonation: Verify the identity of entities claiming to represent Ethereum or USDT. Do not share personal information or send funds to unknown sources.

- Due Diligence: Before participating in ICOs or token sales, conduct thorough due diligence on the project, its team, and its whitepaper.

You can open a case with Cyberspac3.

Conclusion

Ethereum and USDT are two significant pillars in the cryptocurrency ecosystem, offering innovation and stability. However, these assets also attract the attention of scammers seeking to exploit users. By remaining cautious, staying informed, and exercising due diligence, you can protect your assets and navigate the crypto landscape safely. Remember, the cryptocurrency world holds both promise and peril, and your vigilance is the key to safeguarding your investments.